Sales Tax Codes

The main purpose of the sales tax codes is that they include the tax percentage for the sales tax calculation. The sales tax codes are then used in the setup of item sales tax group and the customer and store sales tax group.

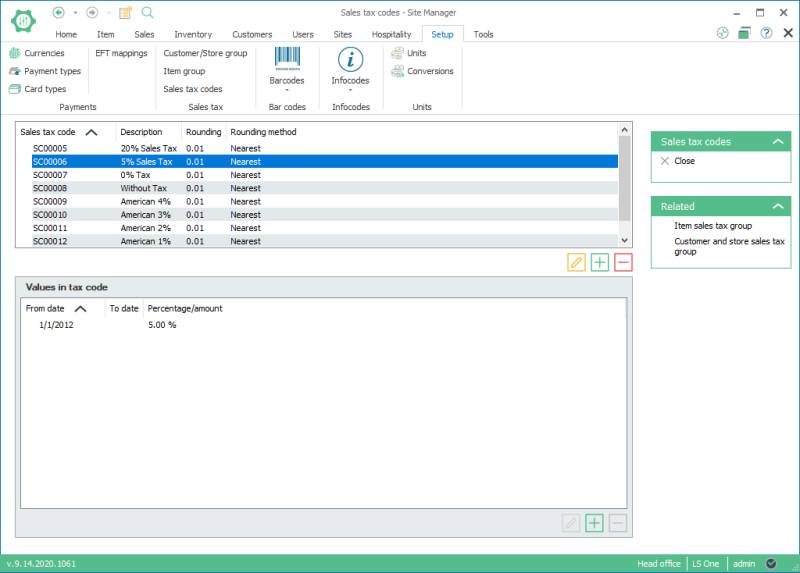

To open Sales tax codes select General setup > Sales tax > Sales tax codes

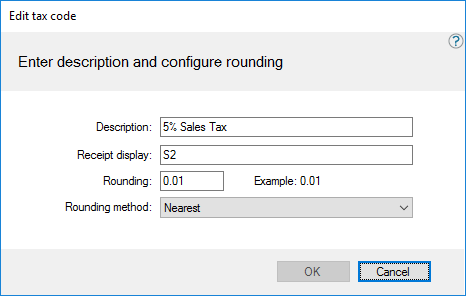

The sales tax codes card:

Each Sales tax code has a Receipt Display ID and a Rounding Rule.

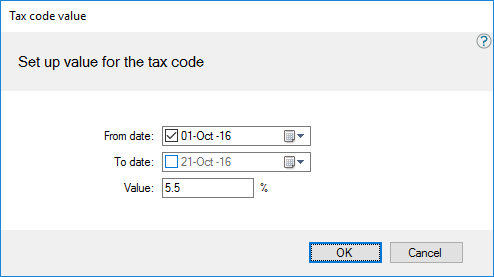

Tax code value card:

For each sales tax code the tax values are set up as lines and configured on the Tax code value card.

The tax code value should be defined for each sales tax code. It is possible to set up many tax code values for each sales tax code which is practical to use depending on dates.

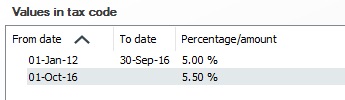

Example: New Sales Tax Value

Regulation demands that tax percentages change on October 1. The user can then change the existing tax value to end before the change and then add a tax value for the sales tax code with the from date as 01.10.2016.

| Last updated: | 2nd November 2016 |

| Version: | LS One 2016.1 |